Buying a house with bad credit but big down payment

Buying a home is as much about your state of mind as the state of your bank accountbut both need to be in. Looking For A Mortgage.

New Rules For Realestate Buyers And Sellers Real Estate Infographic Real Estate Tips Real Estate Information

Ad Bad Credit Mortgage Lenders Easy Process 100 Online Fast Approval Best Rates 2022.

. 640 - 699 Average. Save Money Time Prequalify in Min. Check Your Eligibility for a Low Down Payment FHA Loan.

A loan from the USDA allows you to buy a home in a qualifying rural area with a 0 down payment. Best For an Easy Online Process. Sleek New Designs Innovative Energy Efficient Features.

FHA loans are mortgages guaranteed by the Federal Housing Administration and are great options for. Its important to review different options so you prime yourself for a successful home purchase. New homes for rent.

The standard down payment amount used to be 20 for home buyers. Make a Big Down Payment. Theres a reason bad isnt included above.

If individuals cant get approved for conventional mortgages then FHA loans are the remaining option for hopeful homebuyers with bad credit. If your credit score still falls into the bad or poor category when youre ready to buy a house rest assured you can likely still get a mortgage. Create an Rocket Account Today.

When you have bad credit lenders typically require at least 1000 down or 10 percent of the vehicles selling price whichever is less. Rocket Mortgage is a name you probably know its Americas largest mortgage lender. Visit One Of Our Home Centers To Customize.

10000 Vehicles Available - 1 In Bad Credit Auto Loans - Apply Online Now. Your credit utilization rate is how much you currently owe divided by your. Were Americas 1 Online Lender.

Without this amount qualifying for a car. FHA loans backed by the US. Apply Now With Quicken Loans.

Feb 11 2021 A minimum of 580 is needed to make the minimum down payment of 35. Ad Want a Real Mortgage Solution. Thankfully lenders no longer.

Buying a house when one spouse has bad credit requires considerations. That comes out to 80000 on a 400000 residence funds that very few buyers have. A score under 580 needs improvement and it.

FHA loans with a 10 down payment only. FHA loan requirements are. We Have Helped Many.

Federal Housing Administration require a minimum score of 580 if you make a down payment of 35. One of these is that it creates a cushion of home equity even if housing. Ad Bad Credit Mortgage Lenders Easy Process 100 Online Fast Approval Best Rates 2022.

The minimum credit scores typically needed to buy a house based on Loan Type. You should also keep your credit utilization ratio below 30. Ad First Time Home Buyers.

700 - 739 Good. Its A Match Made In Heaven. Whether youre a seasoned real.

4 Habits of Successful Home BuyersGet Yourself Ready to Buy. Apply Now With Rocket Mortgage. To get the LTV ratio you divide the 170000 loan by the 200000 home value.

A larger down payment means starting out with a smaller loan amount which has a few advantages. Five strategies to buy a house with no money include. Ad Rental Homes Available Near You.

Take the First Step Towards Your Dream Home See If You Qualify. Credit scores evolve with the borrower. Let Us Help You Find A Home.

The minimum required credit score is 580 if you can make a 35 percent down payment. Apply for a zero-down VA loan or USDA loan Use down payment assistance to cover the down payment Ask for a down payment gift from a. Ad 10000 Vehicles Available - Get Your Down Payment Online - Shop and Apply Now.

When it comes to subprime lenders such as banks and other institutions that give loans with bad or no credit usually require a 10 down payment of the loan or 1000 whichever is greater. Ad Compare Mortgage Options Calculate Payments. Most lenders will require a 640 credit score to qualify for the loan along with.

Get Access to Reviews of Top Rated Mortgage Lenders. Ad Your Home Should Be A Place You Love. An FHA loan is likely your best bet for buying a house with bad credit.

Federal Housing Administration require a minimum. If you have a credit score of at least 580 then you can qualify for an FHA loan which is a loan with a lot of flexibility its not restricted to first-time homebuyers for example. The first thing you must do if youre buying a home with bad credit and no down payment is prove you can make mortgage payments despite what your credit history.

Bad Credit Considered Instant Access. Keep your credit utilization rate low. Save Money Time Prequalify in Min.

Get Access to Reviews of Top Rated Mortgage Lenders. So for example lets assume the house you picked is worth 200000 but you put down a 30000 down payment.

Step By Step Guide To Buying A House Home Buying Tips Home Buying Process Home Buying

Pin On Pinterest For Real Estate Marketing

Pin On Real Estate Tips For Buyers

Pin By E Mortgage Finance Corp On E Mortgage Finance Corp Saving Money Buying Your First Home Rent

How To Buy A House With Bad Credit And Low Income

Is Getting A Home Loan Overwhelming You Do You Think You Need A Large Down Payment Are Yo Home Improvement Loans Best Places To Live Beautiful Places To Live

Mortgage Down Payment In Canada What You Need To Know In 2022

Should You Have A Large Downpayment Saved Up For Your Next Home In Depends On Your Situation Shilozit Financial Education Smart Money Financial Literacy

How To Get Your Credit Ready To Buy A House Credit Repair Paying Off Credit Cards Improve Credit Score

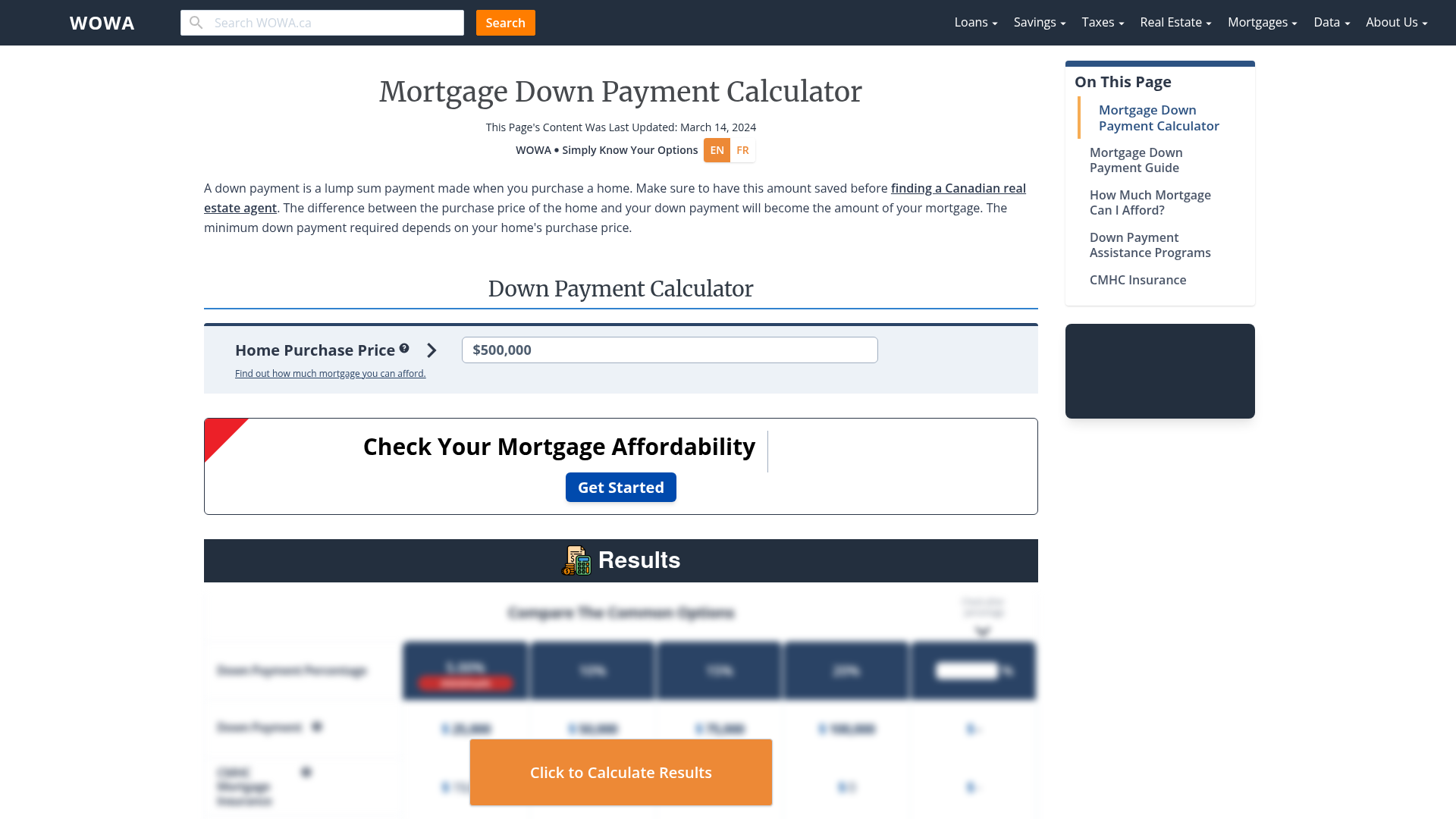

Mortgage Down Payment Calculator 2022 Mortgage Rules Wowa Ca

How To Live On 10 000 A Year Sapling Bad Credit Loans For Bad Credit Refinancing Mortgage

First Time Home Buyers Are Once Again On The Rise And Younger Than Ever Many Still Aren First Time Home Buyers Real Estate Infographic Home Buying Checklist

Money Street Journal On Twitter Home Loans We Buy Houses Home Buying

Pin On Diy Tips

How To Buy A House With 0 Down In 2022 First Time Buyer

How Much Is A Down Payment On A House Do You Need 20 Percent Thestreet

How To Buy A House With No Money Down Bad Credit Home Buying Tips House Home Buying